Why turn to Mine

Since 1941, we’ve been committed to the retirement outcomes of our members and being a trusted super partner in the communities we serve. We know you’re working hard to secure Australia’s future, so we’ll help secure yours. As a profit-to-member super fund, we prioritise the interests of members, not shareholders – meaning we can give more back to members through lower fees and personalised, local service.

How to join

We’re all about making sure our members can achieve the retirement they deserve. Choosing Mine Super means you’ve picked a super fund that’s got your back.

Join online

Join today via our simple online application form and receive your member number in minutes! To get started all you need to do is provide your contact details, how you want to set your account up and your Tax File Number (this isn’t mandatory though and you can add it later!). Your account will be activated once you’ve added money to it, after which you’ll receive a Welcome pack with everything you need to know about your new Mine Super account.

How to make your account financial?

There’s three easy ways you can add money to your super account:

1. Super contributions from your employer.

Provide your employer with the Super Fund Choice Form which we’ve already pre-populated with all of our details. You just need to add in your personal information and hand it to whoever manages your payroll so they can pay your super into your new account.

2. Consolidate your other super accounts.

Also known as a rollover, this is when you add your super from other Funds into your new Mine Super account. For more information on how to combine your super, check out this page.

3. Personal contribution.

With as little as $100 you can start your new account. Once you finish your application, we’ll send you more information on how to do this.

Before joining, make sure you read our Super PDS, Insurance Guides and TMDs to decide if our products are right for you.

The Mine Super difference

Fixed administration fee of 75 cents per week!

We perform for you – 8.43% pa for our High Growth investment option over the last five years (as at 30 June 2024)^.

We’re proud of the Mine Super trophy cabinet with our super Growth investment option the top performing growth fund for FY 2024 and FY 2023* as well as being awarded Money magazine’s Best of the Best Awards for Best Value Superannuation Fund for Young People 2024.

Work in a high-risk or dangerous job? We’ve got your back. Our flexible insurance cover options can help financially protect you and your family if you’re unable to work or if the unexpected happens – and you can change your level of insurance anytime.

We understand the challenges associated with shift work and remote Fly In / Fly Out occupations which is why we have regional offices across Australia and experienced personnel able to make work site visits.

We offer all Mine Super members a complimentary first appointment with Mine Super Financial Advice.

* According to research agency Chant West

^ Past performance isn't necessarily an indication of future performance.

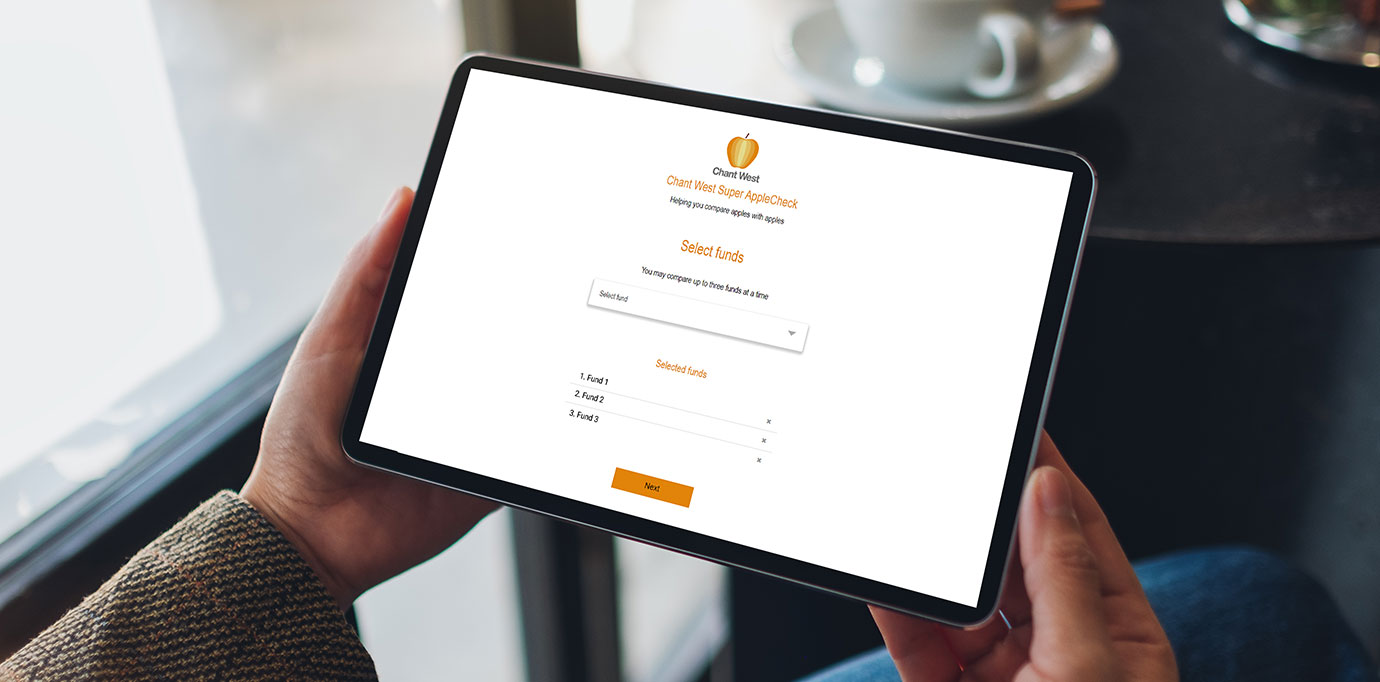

How we compare

See for yourself how we compare against 200 other super funds.

What happens next?

Once you join Mine Super and we receive your first contribution, you can start customising your account or leave it up to us!

Insurance

If you’re eligible, you’ll automatically receive insurance cover. Depending on your needs, you can change your insurance cover, transfer other insurance cover to Mine Super or even take up one of our special offers that allows you to opt in to our Mining Division* where you’ll receive automatic Income Protection without any health assessments!

*Opt-in must occur within 60 days of the date of your Insurance Welcome letter and is subject to eligibility.